Over the course of the next month, I will be releasing a series of China-centered blogs, leading up to my webinar with Dr. Kai-Fu Lee, one of the most plugged-in AI investors on the planet and of the technology’s earliest pioneers.

In the next four weeks, we’ll be covering everything from China’s surging tech investments and the drivers behind China’s growing dominance in AI, to an early look at Kai-Fu Lee’s soon-to-be-released AI Superpowers: China, Silicon Valley and the New World Order.

Today, let’s dive into Chinese venture capital abroad:

By end of 2017, 3,418 Chinese VC funds were launched within the year, raising a combined $243 billion USD, or 1.61 trillion RMB.

Of the $154 billion worth of VC invested in 2017, 40 percent came from Asian (primarily Chinese) VCs. America’s share? Only 4 percentage points higher at 44 percent.

In the first three quarters of 2017, 493 state-backed funds were founded with a capital size of 114 billion USD (756.8 billion RMB).

And as of two years earlier, Chinese VC coffers had surpassed a remarkable $336.4 billion USD.

Artificial Intelligence Technology in China

In a great push to access intellectual property and drive growth in key tech sectors, China’s VC scene is booming.

Despite a looming trade war and Chinese government restrictions on capital outflow, China-based VC funds and corporate investments continue to pump vast new sums into everything from global biotech startups to AI-equipped robotics.

And we are seeing a clear trend towards China’s now RMB-dominated VC market. A whopping 95 percent of the above VCs are RMB funds.

Now the second largest VC market in the world, China’s VC fundraising nearly doubled between 2015 and 2017, in large part driven by the fruition of China’s Internet universe and mounting government efforts.

As to the latter, ChinaVenture recorded 1,166 government-led funds with 5.3 trillion RMB of targeted capital by the end of 2017.

Source: VentureBeat

This astounding growth is part of China’s explosion in private equity. Currently, almost 16,000 limited partners have disclosed investments in private equity and VC funds totaling 6.1 trillion RMB.

But while many of these funds used to be poured into thousands of Chinese copycat companies and local tech startups, we’re seeing a dramatic outward shift in China’s biggest investments.

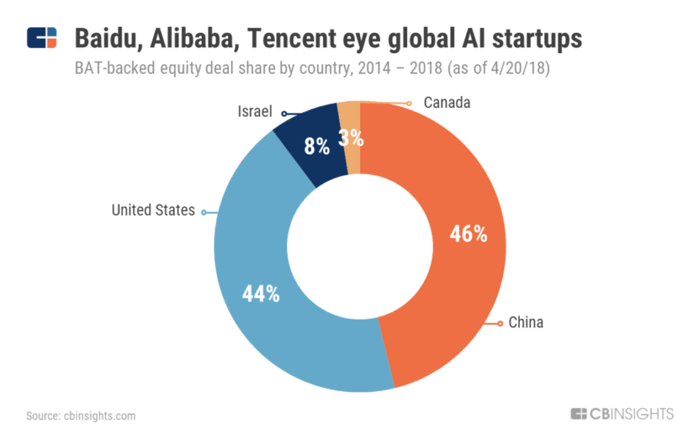

Let’s take a look at BAT-backed startups, for instance.

Source: CB Insights

As Baidu, Alibaba and Tencent take on global leadership in artificial intelligence technology, autonomous vehicles and personalized medicine, China’s corporate VC targets are getting an even split between China and the rest of the world.

And as I’ll discuss in a future blog, China’s government aims to be the global leader in artificial intelligence technology by 2030, a task which requires mass absorption of foreign expertise and foreign data.

Leveraging tremendous government-backed guiding funds and state-corporate collaborations, Beijing can now help bring the world’s top tech talent and intellectual property back to the mainland.

With a heavy focus on future of artificial intelligence, Chinese VC firms are targeting three major arenas:

- Robotics

- Driverless vehicles

- Biotech

Back on the mainland, China’s ultra-high-powered startup ecosystem pioneers the world’s greatest supply of high-tech hardware and newly deployable algorithms.

And now sharing the wealth, Chinese VC abroad plays a critical role in picking out the most promising collaborators to learn from at home and work with abroad.

automated robotics

Shenzhen’s Maker Movement puts China in the unequivocal lead when it comes to hardware manufacturing.

With some of the most industrious (not to mention numerous) electronics engineers in the world, Shenzhen provides a huge leg up to Chinese robotics startups that need to iterate fast.

It’s this unparalleled turnaround rate that in part makes Chinese VC support so attractive to global hardware-reliant startups.

And it’s why savvy Chinese VC funds and investors will often give small U.S. startups of interest a critical gateway to Shenzhen’s abundant resources.

As we start to witness the rise of next-gen technologies like intelligent automated robotics and autonomous drones, this access will be critical, and Chinese VCs will score top global market access in this emerging new sector.

Already in 2016, China accounted for 35 percent of the world’s robot-related patent filings, and Chinese investment has amounted to at least $10 billion per year.

Autonomous Vehicles

As I’ll discuss in a future blog on Baidu, Alibaba and Tencent, these three tech behemoths are forming a ‘national team,’ with Baidu heading up China’s initiative in driverless cars.

Aiming to decimate traffic congestion and build new AI cities, China has a vested interest in the rapid deployment of AI behind autonomous transit.

Added to the mix is the fact that autonomous vehicles are one of China’s weakest points. Given its reliance on elite AI expertise (quality > quantity) -- a luxury still concentrated at Western juggernauts like Google -- autonomous vehicle rollout in China will need as much foreign assistance as it can get.

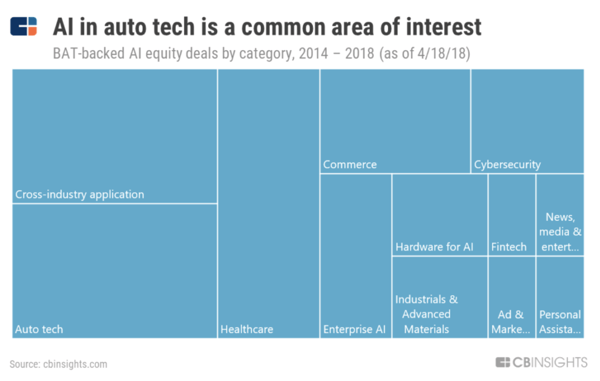

And as seen below, BAT is investing significantly in auto tech, each company announcing its own autonomous driving initiative.

Source: CB Insights

Baidu, for instance, officially announced its Apollo ecosystem last year, reportedly the first comprehensive opening up of automated driving technology and deep learning data.

Bringing on global partners from Nvidia to Renesas, Baidu has surpassed 10,000 developers on the project's GitHub repository, claiming to be the most vibrant AV platform vendor in the industry.

Combining open-software and cloud-service platforms, Apollo strives to enable any automotive partner to efficiently build out their own autonomous vehicles system. And as more partners get on board, Apollo expects to amass significant driving data, speeding up AV technology deployment.

But BAT isn't stopping at open-source platforms to learn from partner data.

Alibaba’s Innovation Ventures (the company’s VC investment arm), for instance, recently participated in a $30 million Series B funding round for Israeli vehicle-to-vehicle networking tech startup Nexar.

Biotech Companies

In line with BAT’s third most heavily backed category, China is investing big in biotech companies.

In Q1 of this year, China-based VC funds poured $1.4 billion into private U.S. biotech firms, making up 40 percent of overall funds raised. This figure is up from $125.5 million a year earlier, indicating a major shift in China’s healthcare-oriented focus.

Among the Chinese investors, Tencent and Baidu Ventures made a joint investment in American deep learning-based drug discovery startup Atomwise. And of Baidu’s five other U.S. deals, the company’s VC arm invested in healthcare AI startup Engine Bioscience.

Just as China has worked its way from a largely ‘copycat’ tech ecosystem to a thriving hub of innovation and cutting-edge research, Beijing is trying to do the same in healthcare.

By investing big in foreign (particularly AI-based) biotech companies, China aims to shrug off its reputation as a low-grade generic pharmaceuticals manufacturer and begin pioneering novel therapies.

Given China’s enormous population and overwhelmed medical institutions, predictive analytics and personalized medicine could unleash dramatic economic value. And as biotech emerges as one of the most profitable and disruptive technologies, Chinese VCs may soon help the country cash in.

Final Thoughts

China is a true miracle story.

After reaping the harvest of a cheap manufacturing sector and export-oriented economy, China is upending traditional investment flows at a rate previously unheard of.

Diving into everything from autonomous drones to AI-driven diagnostics, Chinese VC firms are gaining a hold of global markets everywhere, amping up China’s access to elite tech expertise and valuable new data.

And as international startups position themselves to take advantage of China’s strategic generosity, these Chinese giants will both solidify growing influence at home and technological dominance abroad.

Join Me in China

(1) Webinar with Dr. Kai-Fu Lee: Dr. Kai-Fu Lee — one of the world’s most respected experts on AI — will discuss his latest book AI Superpowers: China, Silicon Valley, and the New World Order. Artificial Intelligence is reshaping the world as we know it. With US-Sino competition heating up, who will own the future of technology?

Register here for the free webinar on September 4th, 2018 from 11am - 12:30pm PST.

(2) Abundance Global - China: This year, I’m expanding A360 into three key emerging global markets: Central/South America (Rio de Janeiro, Brazil); MENA (Dubai, UAE); and Asia (Shanghai, China). Following my annual China Platinum Trip, A360 Shanghai will dive into China’s remarkable strides in AI and other newly emerging industries.

Abundance Insider: August 3rd, 2018 Edition

Podcast Episode 57: Who, Not How