AI is about to become the biggest investment theme in the world. So how do you get started investing?

In 2023, more than 1 in 4 dollars invested by VCs in US startups went to an AI-related company.

And investors are already pouring tons of cash into AI companies in 2024. Two weeks ago, Bloomberg reported that we saw an “AI January,” with several big deals announced last month. These include OpenAI Chairman Brett Taylor’s announcement that he is raising capital from Sequoia that could value his new startup, Sierra, at nearly $1 billion; as well as NVIDIA joining a $150 million investment in chatbot-builder Kore.ai.

This trend will continue to accelerate.

Global banking and investment firm Goldman Sachs estimates that global investment in AI could reach $200 billion by 2025 (next year!), double the amount invested in the field in 2022. Forecasts by Zion Market Research suggest that this total could more than double again to $422 billion by 2028.

To put this in historical context, as the Goldman Sachs report points out:

“Innovations in electricity and personal computers unleashed investment booms of as much as 2% of U.S. GDP as the technologies were adopted into the broader economy. Now, investment in artificial intelligence is ramping up quickly and could eventually have an even bigger impact on GDP.”

So, how should you approach investing in AI? Do you currently have a strategy?

In today’s blog, I’ll discuss my own approach to investing in AI, share details of some of my own AI investments, and perhaps most importantly, provide some principles and general guidance. (Note: don’t invest money you can’t afford to lose.)

This March, the primary theme of my annual mastermind (the Abundance Summit) is focused on AI: “How to think about it, use it, and invest in it.”

Let’s dive in…

My AI Investments

I’m convinced that AI is the single most important technology we’ve ever created—and one that has the greatest potential to uplift humanity.

Here are some of the private AI companies that I’ve invested in personally and/or through my venture fund BOLD Capital:

-

Figure AI: Figure is an extraordinary humanoid robotics company that went from a clean-sheet design to a walking humanoid robot in less than 12 months. Brett Adcock, the visionary founder, wants to redefine the future of labor and technology and has a personal goal of manufacturing and deploying 1 million Figure units by 2030. And just last month, Figure announced that it was in talks to raise as much as $500 million in a round led by Microsoft and OpenAI.

-

Insilico Medicine: Insilico, led by Founder and CEO Dr. Alex Zhavoronkov, is on a mission to revolutionize the traditionally slow and costly process of drug discovery by using AI to rapidly identify novel drug targets, test drug candidates, and output those that are ideal for further development. They have harnessed AI to accomplish with 50 people what a typical drug company does with 5,000. That’s increasing the power of drug discovery by 100x!

-

Stability AI: Stability is the world’s leading open source generative AI company. They are funding the development of open-source systems generating code, images, language, and music. Founder and CEO Emad Mostaque is one of the world’s leading experts in AI, and will be joining me at my upcoming Abundance Summit next month.

-

Daily AI: Daily.ai allows you to publish AI-powered email newsletters that generate 40-60% daily open rates without you having to write a single piece of content. The platform supercharges your marketing and customer engagement capabilities “automagically.”

-

Liquid AI: Liquid is an innovative neural net company that is a spinout from MIT’s Computer Science and Artificial Intelligence Lab (CSAIL). They went from an idea to raising $5 million at a $50 million valuation, to then raising $37 million on a $300 million valuation—in 6 months. I’ll have both cofounders of Liquid AI at the Abundance Summit as part of a group of next-generation AI entrepreneurs.

Now let’s look at some actions you can take as an investor…

4 Ways to Invest in AI Companies

So, how can you start investing in AI companies?

Here are 4 options. (Remember: don’t invest money you can’t afford to lose.)

Public Markets

If you’re an investor in the public markets, the choice is easy. Many of the true AI companies are significantly depressed and have huge, continued upside.

Here are my top 10 (in alphabetical order):

-

Amazon (AMZN)

-

Apple (AAPL)

-

Google/Alphabet (GOOG)

-

IBM (IBM)

-

Meta (META)

-

Microsoft (MSFT)

-

NVIDIA (NVDA)

-

Palantir (PLTR)

-

Salesforce (CRM)

-

Tesla (TSLA)

Private Companies / Startups

If you’re interested in private companies still in the realm of venture investments, you’ll want to find a smaller venture fund to invest through.

It’s critical for you to ask to see their track record in finding AI companies early in their pre-seed, seed, and Series A funding. Ask them to show you their track record of early-stage exits. The fact is those venture funds that get early access to deals will continue to get early access and will consistently come out on top. Allocate some capital in a few of the VCs you’re able to access.

I’m mentioning smaller funds here because it may be difficult to access the bigger funds as a solo investor. You can find details on investment rounds by searching for breakout companies on Crunchbase.

Angel Investing

Attend the demo days at Y Combinator and similar accelerators and incubators. Go hang out at Stanford and MIT and ask the graduate students who they know who’s starting fun AI companies.

Allocate lots of small checks to these entrepreneurs. Stay in touch. Add funding at every stage as they continue to hit their milestones.

I know the guy who put the first $100,000 into Larry Page and Sergey Brin when they just started Google out of Stanford. He is a very happy man! Rinse and repeat.

If you’d like to go deeper on angel investing, here are two longform articles by Naval Ravikant, the founder of AngelList and a prolific angel investor: How to Angel Invest, Part 1 and How to Angel Invest, Part 2.

Connect with Other Investors

Find a community of investors. This will help you get more deal flow, which is one of the most important parts of angel investing.

I have one called Abundance360 and many members are active investors, but there are many other communities out there.

Mapping the AI Landscape

One of my Abundance360 members, George Bandarian, from Untapped Ventures, has a very helpful for framework for viewing the landscape of AI companies from the perspective of an investor. I’ll summarize it below:

First, all AI companies fall into 2 buckets:

1. Companies USING AI:

-

Their core product isn’t AI but they use the tech to cut costs and boost revenue.

-

These companies tend to market themselves as “AI-enabled” or “AI-powered.”

-

Many of these companies have taken advantage of the increased hype around AI to raise awareness and funding.

2. Companies BUILDING AI:

-

For these companies, their core product is AI and they generate revenue and products directly from selling this AI product.

-

Their focus is on using AI to solve customer pain points.

-

These companies can have different levels of value creation (explained below).

Second, Bandarian sees AI companies existing across 4 “layers of value creation”:

-

Applications: End products / apps. It can be hard for companies building apps to create a moat.

-

Infrastructure: Tooling for application engineers. This space offers promising investment opportunities.

-

Models: These are what enable “magical transformations.” This is the ideal target space for investment opportunities.

-

Compute: The hardware used to run models. This is a good space for investment opportunities, but it’s hard.

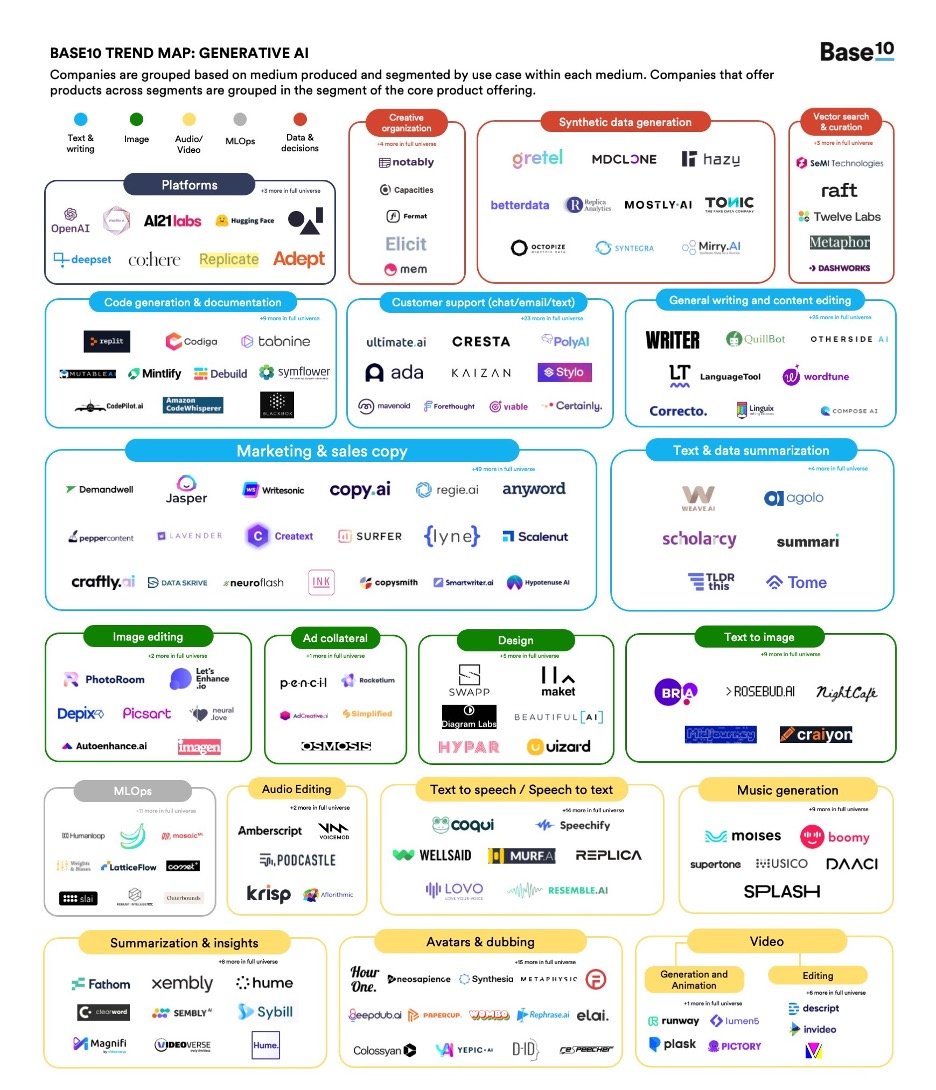

It can also be helpful to see a visual layout of the AI landscape. For example, the VC firm Base10 created the below Generative AI Market Map and posted it to Twitter/X last year:

Advice from a Pro – Dave Blundin

When I was at MIT, living at my fraternity (Theta Delta Chi), I had two brothers who have gone on to become rather famous in the tech investment world... Michael Saylor (Co-Founder & Executive Chairman, MicroStrategy) and Dave Blundin (Founder, Cogo Labs, Link Ventures, and Exponential Ventures).

Dave Blundin built one of the first deep learning companies which he exited for over $1 billion, has built at least 5 unicorns, and deployed $500 million in venture funding over 17 years with spectacular returns.

When I caught up with him about investing in AI, here were his top 5 points of investment advice:

1. Look Beyond the Giants: Focus not just on established tech behemoths, but also on the potential of emerging startups that could be the next big disruptors in AI. He references Bill Gates' concern about competition from emerging talents in garages, not just big names, pointing out that the future will likely see new companies achieving trillion-dollar valuations.

2. Invest Early in Rapid Growth: Capitalize on startups with high momentum in their early stages, where the cycle times for growth are becoming increasingly shorter, offering potentially higher returns. Blundin favors investing in early-stage companies with the possibility of high internal rates of return (IRR).

3. Talent Over Everything: Blundin emphasizes the importance of talent over all other factors, suggesting that capital and market opportunity are abundant. The real challenge is finding and nurturing the right team.

4. Leverage Accelerators and Funds: For new investors, the complex AI landscape is best navigated through funds, especially those associated with accelerators or universities, which provide the necessary support and resources. For later stages, direct investment is possible but competitive.

5. Look to Public Companies Investing in Training: For public AI companies, he lists major players like Microsoft, Google, Tesla, NVIDIA, and Amazon, noting that even non-traditional AI companies like Palantir could benefit from the AI wave due to their data and automation capabilities. Interestingly, Blundin highlights Meta's massive investment in AI training, which could democratize AI capabilities for startups.

Why This Matters

AI is massively demonetizing and democratizing, giving more and more entrepreneurs and companies opportunities to innovate and create wealth.

The result is that an increasing number of small, fast-moving teams of entrepreneurs are having an even bigger impact. For example, I recently spoke with a friend in Australia who has just raised money for his company: his goal is to build a $100 billion company with just 12 employees!

If you’re interested in investing in AI, NOW is the time to fully engage.

As I keep saying…

“There will be two kinds of companies at the end of this decade: those that are fully utilizing AI, and those that are out of business.”

Will AI Replace All Coders?

How AI Will Extend Your Life